Boohoo.com PLC stated that it plans to acquire part of the intellectual property of Nasty Gal Inc., which does not include the latter’s operating costs, such as the rental expenses of two physical stores. In addition, sales of retro apparel and third-party brands are not within the scope of the transaction. . The e-commerce company had spent a total of 3.3 million pounds two weeks ago to acquire a 66% stake in 21Three Clothing, the parent company of the British small-scale fashion e-commerce company Pretty Little Thing. Pretty Little Thing was founded by Umar Kamani and Adam Kamani, two sons of co-founder and co-CEO Mahmud Abdullah Kamani of Boohoo.comPLC.

British fast-fashion e-commerce Boohoo.com PLC (BOO.L) has already proposed to acquire US-based bankruptcy Nasty Gal Inc. for US$20 million and £16.1 million to confirm market information at the end of November.

Boohoo.com PLC announced today that its subsidiary, Boohoo FIL Limited, will participate in the bid of Nasty Gal Inc. and will be the "stalking horse" in the bankruptcy auction of Nasty Gal Inc., that is, Nasty Gal Inc. selected Boohoo.com PLC2000. The tens of thousands of dollars is the minimum protection price. Later buyers can only increase their prices to avoid Nasty Gal Inc. being forced to accept the low price purchase proposal.

Boohoo.com PLC stated that it plans to acquire part of the intellectual property of Nasty Gal Inc., which does not include the latter’s operating costs, such as the rental expenses of two physical stores. In addition, sales of retro apparel and third-party brands are not within the scope of the transaction. . The e-commerce company had spent a total of 3.3 million pounds two weeks ago to acquire a 66% stake in 21Three Clothing, the parent company of the British small-scale fashion e-commerce company Pretty Little Thing. Pretty Little Thing was founded by Umar Kamani and Adam Kamani, two sons of co-founder and co-CEO Mahmud Abdullah Kamani of Boohoo.comPLC.

In a statement today, Mahmud Kamani and another co-CEO CaroKane of Boohoo.com PLC pointed out that the successful acquisition of Nasty Gal Inc. will add a mature global brand to the Boohoo family and is the ideal next step for attracting young international customers.

According to statistics, at present, the international market contributes 36% of revenue to Boohoo.com PLC. In the first half of fiscal year ending in August, the U.S. market showed the highest growth, with a fixed rate of 81%, while the United Kingdom, Europe, and ROW also increased by 38%, 41% and 27% respectively.

Fashion Ecommerce NastyGal Store

Boohoo.com PLC had previously been registered in the United Kingdom with a new company named Nasty Gal Ltd. two weeks after Nasty GalInc filed for bankruptcy on the 7th in the United States. There is no doubt that Nasty Gal Inc. can complement Boohoo.com PLC while expanding its US market. Nasty Gal Inc., established in 2006, targets young people and young women in their 20s and basically coincides with Boohoo.com PLC.

Nasty Gal Inc. recorded annual sales of US$77.1 million in the fiscal year to the end of January 2016, a year-on-year decrease of 9%, EBITDA loss doubled from US$6.3 million in the previous year to US$15.4 million, and after tax loss reached 21 million. Dollars. In fact, Nasty Gal Inc., formerly known as eBay's online shop, went down three years in 2010-2012 after it was established four years later, and then went through a geometric increase in 2012. After that, it went from bad to worse. According to the bankruptcy document, the company was established in September 2015. Peter J. Soloman Co. was hired to find a buyer, but the continuous deterioration of the business led no one to take over.

Nasty GalInc. founder Sophia Amoruso holds a 55% stake in the company. In 2012, she sold a minority stake in Nasty Gal Inc. for $9 million to Index Venture, a private equity fund that had invested in Net-a-Porter, Esty Inc. (NASDAQ:ETSY) and ASOSPLC (ASC.L). After the company's income surged, Index Venture invested an additional $40 million. In early 2013, Sophia Amoruso planned to sell to clothing retailer Urban Outfitters Inc. (NASDAQ:URBN). Nasty Gal Inc.'s latest round of financing was a year and a half ago, before the failure of Apple Inc. (NASDAQ: APPL) Apple’s former retail director, JCPenney Co. Inc. (NYSE:JCP) Penny's Department Store in March 2015. CEO Ron Johnson led a $16 million Series C round of financing, and the company's total financing over the 10 years was only $65 million.

And Boohoo.com PLC is the most popular chicken on the open market this year. As of the close of the market on December 23, Boohoo.com PLC (BOO.L) has risen more than 2.5 times in 2016, dominating Western European consumer listed companies with market capitalization above US$500 million. Today, under the influence of M&A rumors, the stock rose as much as 3.8% to 137.25 pence, approaching a historical high of 137.75 pence.

The explosive rise in stock prices, apart from the pursuit of investors, there is real performance support. According to No Fashion Chinese Network (micro-signal:nofashioncn) data, Boohoo.com PLC sales rose 40.2% year-on-year to £127.3 million in the first half of the fiscal year. The company recently raised its full-year sales forecast for the fourth time this fiscal year. It is now expected that In the fiscal year 2017 ending on February 28, 2017, sales will achieve 38%-42% rapid growth.

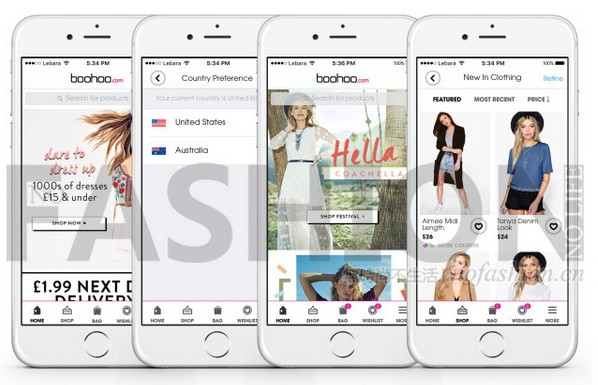

Boohoo.com mobile

The Boohoo.com PLC, which draws on Zara's fast-fashion model, is the world’s fastest fashion retailer. Simon Bowler, retail analyst at BNP Paribas SA (BNP.PA) BNP Paribas pointed out that the delivery time of Boohoo.com PLC is only 1-2 weeks, twice as fast as Zara. Boohoo.com PLC has only a small number of first orders for each product, and half of them are manufactured in the UK. After the product is on the shelves, it is decided whether to increase orders based on sales. Chairman of the company Peter Williams pointed out this test-repetition when he accepted a Bloomberg interview. The "testandrepeat") model means that young people who want to buy and wear can quickly provide the style they want to buy, and they can wear the ordered products at the next day's delivery speed, while focusing on online sales. The company can collect data more quickly.

The target customer base is also an important success factor for Boohoo.comPLC and its newly acquired Pretty LittleThing. Although the general business of selling clothes is difficult to do now, it is much easier to sell to "dead sisters" who are over ten or twenty. They are poor and have low quality requirements, but they are easily affected by cyber reds and celebrities, as well as having the instincts of all women - like buying, buying and enjoying the feeling of wearing new clothes.

So Boohoo.com PLC's speed and low price are tangent to their needs. Co-CEO Carol Kane told the Daily Telegraph that their return rate is not high, because unlike the mid-market, young people have a limited wallet and they will not spend £40 to buy two sizes of the same dress because They can only spend 20 pounds.

Boohoo.com PLC, which was listed at the beginning of 2014, has also fallen short and has issued a profit warning in early 2015. Chairman Peter Williams said it is difficult to predict what will happen next year, but the moment is certainly an exciting time.

Boohoo.com PLC (BOO.L) closed at 136.5 pence on Wednesday on the 28th, an increase of 3.2%. It has expanded the cumulative increase so far in 2016 to nearly 270%.

Pillow Covers,Pillow Shams,Custom Pillow Cases,Cotton Pillow Covers

Shaoxing Jinsai E-commerce Co.,Ltd , https://www.mangatacasatextile.com